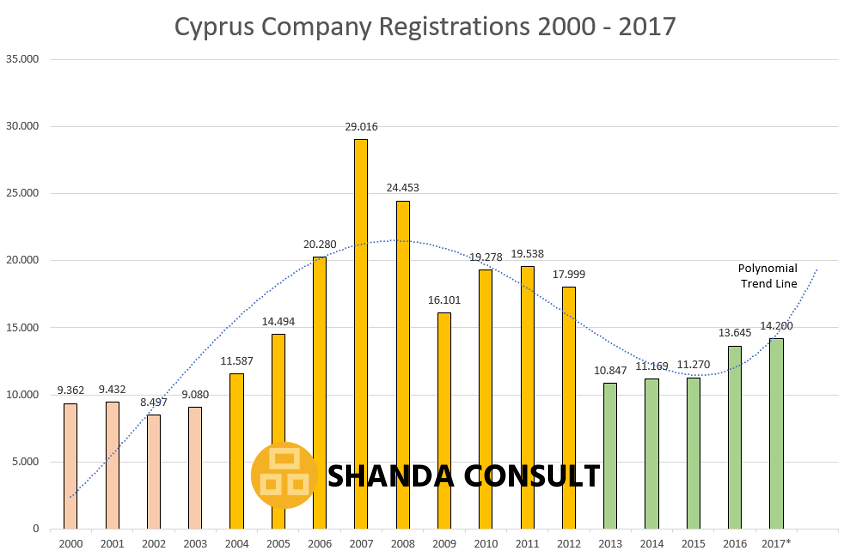

Cyprus is well known as a preferred country for holding companies, international or regional headquarters and investment companies. Cyprus continues to be the place of choice for many international businesses and business people, and for investors. Consequently, Cyprus company registrations are continuing its upward trend as well in 2017.

*) Estimated based on Cyprus company registrations until 31/08/2017

The return of confidence of international businesses in Cyprus since the crises in March 2013 is well reflected in the annual amount of company registrations in Cyprus. The above green bars are showing a continuous upward trend of Cyprus company registrations since the sudden decrease in 2013. The polynomial trend line shows a further increasing trend for 2018.

Cyprus company registrations during the offshore years

The number of annual company registrations in Cyprus has typically been around 8.500 – 9.000 until 2003. Those were the years prior to the EU accession of Cyprus in May 2004. The upcoming EU accession of Cyprus required substantial changes and amendments of many laws of Cyprus. One of the conditions to become an EU member was the abolition of the offshore tax legislation of Cyprus. Back in 2002 and 2003, it was believed in Cyprus that the abolition of the offshore legislation and its tax advantages would damage the attraction of Cyprus as a jurisdiction for international businesses and thus negatively affect the related service industry of Cyprus.

However, right from the days of EU accession, the annual number of Cyprus company registrations increased unexpectedly and reached new records until 2007.

When confronted with the condition to abolish its offshore tax regime prior to the EU accession, Cyprus made a wise move. The government and the parliament decided to rigorously change their entire tax regime, making it one of the most attractive tax regimes within the EU. A huge number of specific tax provisions and regulations was cancelled and replaced with a simple, straight forward and transparent tax legislation, providing for a taxation of business profits by 10 % corporate tax. Meanwhile, the rate has been increased to 12,5 %.

Additionally, the new tax legislation provided for tax exemption of several income classes. Those exemptions do continue today. There is now withholding tax in Cyprus, profit from the disposal of securities, including company shares, are not taxed and repatriation of assets in the course of liquidations are not taxed.

Back in 2012 and 2013, shareholders of offshore companies had the option to choose either a step-by-step adaptation of their tax rate to the general corporate tax rate of 10%, or to register new Cyprus companies and to liquidate their offshore companies.

As clearly seen in the years 2003/2004 in the above chart, around 25% if the offshore companies opted to register new, onshore companies, which resulted in a sudden increase of Cyprus company registrations.

Cyprus’ EU accession (2004): a boom for Cyprus company registrations

However, during first years after Cyprus’ EU accession (2004) saw the industry booming. International businesses understood the substantial advantages of EU harmonisation of the laws of Cyprus, now benefiting from the single-market advantage, EU-wide tax legislations, EU directives such as, for example, the EU Parent Subsidiary Directive, and many more. Cyprus company registrations jumped to its peak in 2007.

After 2007, Cyprus company registrations settled down to an average of around 18.000 to 19.000 company registration annually.

The crises of Cyprus in March 2013 resulted in a sudden decrease of Cyprus company registration. At that time, many international businesses lost confidence in Cyprus as a jurisdiction. The loss of confidence in Cyprus was not only rightfully caused by the crises itself. The media in some EU countries, in Russia, Ukraine and in some other countries drew a heavily exaggerated picture of the situation of Cyprus, Additionally, many governments used the opportunity of the day to blame Cyprus for extensive money laundering. There is no doubt that money laundering took place in Cyprus, but not in the way and the scope that some governments suggested.

Inreasing number of Cyprus company registrations as a result of returning confidence in the country

After the crises in March 2013, Cyprus company registrations increased moderately but steadily every year, a clear sign for returning confidence of international businesses, financial companies and investors.

The annual number of Cyprus company registrations reached 13.645 at the end of 2016, up from only 10.847 in 2013. Based on the number of company registrations until 31 August 2017, the total number of Cyprus company registrations is expected to reach 14.200 at the end of 2017.

The polynomial trend line shows a further upwards trend of Cyprus company registration in 2018.

Thus, Cyprus remains the most beneficial international jurisdiction and place of business for international companies and investors within the EU, providing all advantages of harmonised EU legislation.

If you plan to register a company in Cyprus, we will be happy to advise you in accordance with your needs and your current situation. Shanda Consult is a one-stop licenced service provider, providing services such as Cyprus company registration, fiduciary services, company administration and management, accountancy and tax services, and many more. Shanda Consult is furthermore specialised in industrial investment consulting and the facilitation of industrial Joint Ventures, including Joint Venture Partner searches. Simply contact us now.