The purchasing power of physical gold and silver – hedging inflation and economic risks

Physical gold and silver are one of the most preferred ways to protect wealth on the long term. As physical gold and silver are outperforming any currency on the long run, they are one of the best solutions to safely transfer wealth to the next generation. Read why…

A few striking examples how physical gold and silver keep value over currencies and other forms of investment:

- Based on USD prices, during the period 1974 to 2014, the cumulative return of physical gold was 3 times of the cumulative return of the S&P 500 Index.

- In the USA, 0,72 oz of silver was buying one gallon of gasoline in 1910, and in 2014 as well. However, the price for one gallon of gasoline in the USA was USD 0,10 in 1910, but USD 3,61 in 2014, an increase of 3.600%.

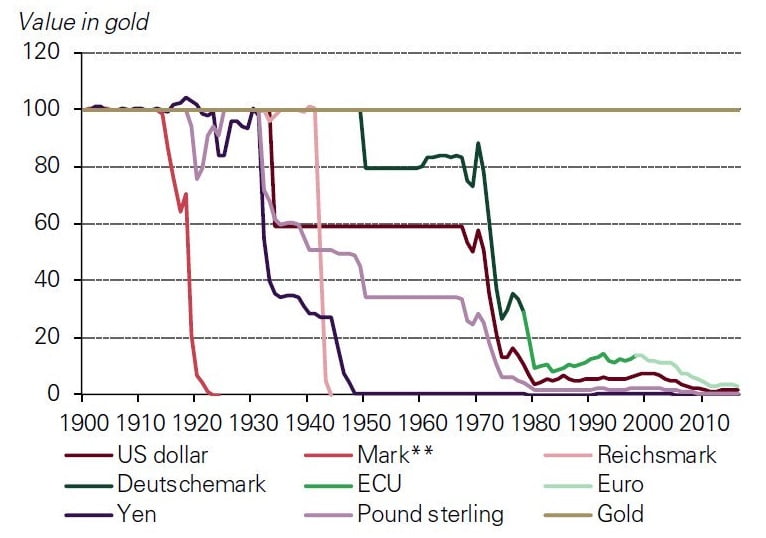

In other words, although the gasoline price increased by 3.600% during 1910 and 2014, the quantity of silver needed to buy one gallon of gasoline is still the same. - From 1900 until 2017, gold outperformed all major currencies, as seen on below chart.

Gold outperformed all major currencies since 1900:

Source: Reuters, Bloomberg

Gold – a century of outperforming currencies

Investment in physical gold is often intended to compensate inflation losses of currencies. The above chart proves the effectiveness of this strategy. Over the last 100 years, gold has heavily outperformed currencies. Global gold production increases 2% annual in average. However, there is no limit to printing banknotes.

Reasons that suggest a substantial rise of gold prices in 2018

Gold analyst Dan Popescu said in April 2018:

“… Gold has recently broken from a technical consolidation formation within a secular bull market started in 2000 ($250) with a potential technical target of $1,450 by the end of the year. Uncertainty in geopolitics with risk of military conflict is gold’s best friend. We had currency wars since 2008, trade wars since 2018 and it looks like military wars are not far. These are ideal conditions for a quantum leap for gold that can push it even above $2,000. Fed’s past chairman Bernanke recently called the present international monetary system “incoherent” and the governor of the Bank of England Carney in 2011 considered the system at a “Minsky moment”. It is I say in unstable equilibrium and ready to collapse and bullish gold.”

More in detail, reasons that suggest a raise of the gold price this year and in future:

- Gold for risk diversification: Gold outperformed the S&P 500 Index since decades. Therefore, owning physical gold is a relatively comfortable way to reduce the general risk of investments by ways of diversification. Investors will continue to diversify their investments by buying gold for their investment portfolio during the next 10 years.

- Growing global gold demand: Gold prices are formed by supply and demand. Growing demand in gold from emerging-market economies does not seem to slow down. Right now, beginning of July 2018, the gold and silver mints in Switzerland and neighbouring countries are not able to offer prompt delivery. When ordering gold from a mint in Switzerland, delivery is around mid of August 2018, and delivery of silver in about three months.

- Need for safety: Gold is perceived as a safe haven in times of crises and economic turmoil. Cautions investors’ choice during such times is physical gold, preferably stored outside of the banking system. Well known large investors, including Carl Icahn and George Soros, are predicting a substantial stock market crash in the near future. If their opinion comes true, many small and large investors will run on physical gold.

- Rising global debt levels: Debt levels of many countries continue to grow rapidly, it seems to be easier to print money then to keep national budgets within limits. When national banknote printing presses continue rotating and when national indebtedness increases, investors get concerned and invest in gold. It is not likely that the problem of increasing indebtedness will be addressed with success during the coming years.

- U.S. Dollar may be at its peak: Although the US Dollar has slightly decreased recently, it still remains near its highest level since 2003. Political and economic developments may not further support the US Dollar, which would lead to a decrease from its highly supported current level. This will probably increase the demand in gold, as it happened in the past.

- Hedging inflation: During the past, gold prices generally increased with increasing cost of living. This tendency makes gold a good hedge against inflation.

- Negative Interest Rates: Decreasing and/or negative interest rates have always been triggering increase of the gold price, as it becomes extremely difficult to generate any significant gains from currencies or bond yields.

- Wealth protection since centuries: Particularly physical gold, as well as silver, stored outside the banking system, has been perceived as an intrinsic value. This view has recently seen substantial support by a number of central banks, which either withdrew their physical gold from storage facilities in other countries or heavily increased their physical gold stocks by way of purchasing.

The global crises in 2008 opened the eyes of many people. Not only investors had to watch how irresponsible market behaviour can lead to almost catastrophic results around the globe. The current behaviour of the big players on the money and mortgage markets does not create real trust that a major systemic crisis will not repeat. - Gold is liquid and portable: Physical gold with the purity of 999,9 is treated on the markets equal to cash money. Therefore, it is absolutely liquid and can be sold easily.

Physical gold is portable, especially if stored outside the banking system.

For more information about gold and silver and about our safety storage and trade services for physical precious metals, please view our dedicated website.

Important warning: The above evaluations are the opinion of the authors, which may not materialise in future. The authors do not hold any position in any precious metals at the time of writing this article.

Prices of the past do not necessarily repeat in future. Technical analyses may not be correct or even fail under unexpected influential developments in global and national politics, crises, economic developments, natural occurrences etc.

Do only consider investing funds that you do not need for your current life style or to cover your liabilities!