Cyprus is further consolidating as the sought-after business jurisdiction in Europe

Cyprus Company Registrations continue to outpace dissolutions as business confidence remains strong

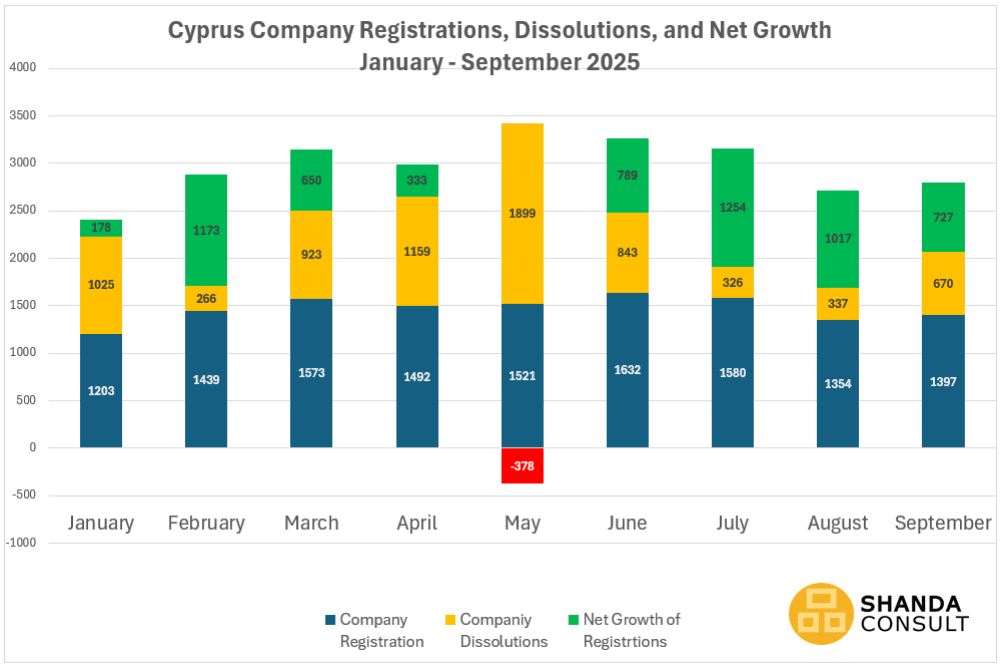

Cyprus company registrations and dissolutions are important indicators of economic sentiment, entrepreneurial appetite, and market resilience. In Cyprus, the first nine months of 2025 paint a broadly positive picture: new company formations clearly exceed dissolutions, confirming that business activity and entrepreneurship remain dynamic.

Overall: The momentum of Cyprus company registrations is up

- From January to September 2025, Cyprus recorded 13,191 new company registrations – an 8.7 % increase from the same period in 2024 (12,140).

- In that same span, there were 7,448 company dissolutions – down 11.4 % from 8,402 in 2024.

- Net Cyprus company registrations (registrations minus dissolutions) rose to +5,743 in 2025, up from +3,738 a year earlier – a 53.6 % improvement.

(Source: Cyprus Company Registrar)

What do the data tell us, and what can be expected?

With the increasing net number of Cyprus company registrations, the data indicate that Cyprus remains attractive for company formation: favourable regulatory framework, tax regime and global connectivity.

The decrease of company dissolutions suggests strengthening resilience.

The widening gap between new registrations and dissolutions is a clear positive indicator of business confidence in Cyprus.

Global headwinds (inflation, interest rates, geopolitical risk) are expected to increase investor sentiment.

If the current trajectory holds, 2025 may rank among the strongest years for net company creation in Cyprus.

Cyprus is showing renewed entrepreneurial vitality and remains an attractive business location.

Why is Cyprus so attractive for entrepreneurs and investors?

The increasing number of Cyprus company registrations, up 8.7% during the first 3 quarters of 2025, compared with the same period in 2024, clearly shows that businesspeople and investors are increasingly convinced that Cyprus is the best option for them to set up a new business, to relocate their existing business, to set up regional headquarters for better reaching regional markets, or for their investments.

The interest to set up business or to invest in Cyprus is not only coming from EU member states, but also from the UAE, namely from Dubai, from North African countries, from the USA, from India, from South East Asian countries and the Far East, and recently from South American countries as well.

The main reason of Cyprus company registration for businesspeople and companies from outside of the EU is benefiting from the advantages of Cyprus as a gateway into the EU markets.

In case of entrepreneurs and companies from the UAE, the main reason is that the UAE introduced 9% corporate tax for most businesses, and the increasing administrative and living costs in Dubai.

Entrepreneurs and companies from other EU countries do prefer to relocate to Cyprus due to an array of reasons, be it the ease of doing business, be it the better and more relaxed lifestyle than in their home countries, or be it to be closer to their target

All businesses and investors do of course also benefit from the very business- and investment-friendly tax rates and rules in Cyprus

The corporate tax rate in Cyprus is 12.5%, expected to be increased to 15.0% in 2026. But it is not only the corporate tax rate that attracts. Important is the tax base, i.e. what is taxed and what not.

In Cyprus, there is no tax on the profit from the disposal of securities in the widest sense, including privately held shares. When a Cyprus company is selling its shares held in another company, the net revenue deriving thereof is not subject to any tax, for both companies and individuals.

Furthermore, individuals relocating to Cyprus are exempted from any taxes on their worldwide income from dividends and interest, based on the Cyprus non-dom tax status.

Last but not least, there is no withholding tax in Cyprus (exceptions exist), no inheritance tax, no gift tax, and no real estate tax.

The annual tax allowance on the income of individuals is €19,500, expected to be increased to €20,500.

s

Considering Cyprus as the new home for your business, and maybe even for you and your family? Or you are just curious about Cyprus company registration and the advantages of Cyprus?

Pend us a message through the form below, and we will arrange a free-of-charge initial video meeting.

a

Disclaimer:

The information provided in this article is for general informational purposes only and does not constitute legal, financial, or tax advice. While we strive to ensure that the information presented is accurate and up to date, tax laws and regulations are subject to change and may vary based on individual circumstances. We strongly recommend consulting with a qualified tax advisor or legal professional before making any financial or business decisions based on the information provided here.

Shanda Consult does not accept any responsibility or liability for any loss or damage incurred as a result of the use of this information.

s