Spain and Cyprus: Business and Tax | A Comparative Guide

A growing number of Spanish businesses and international investors are benefiting from the business-friendly tax rates and supportive business environment of Cyprus. The increase of Spanish business interest in Cyprus is also supported by the growing number of vacancies for Spanish-speaking candidates at all levels.

This article, “Spain and Cyprus: Business and Tax | A Comparative Guide”, provides a detailed overview of the advantages of Cyprus for entrepreneurs and individuals, including a comparative guide on taxes in both Spain and Cyprus.

s

Spain: An important economy with high tax burdens for businesses and individuals

With a nominal GDP of €1,48 trillion (2024, est.) and a purchasing power parity (PPP) of €2,24 (2024, est.), Spain is the 6th largest economy in Europe and ranks 15th globally. The population of Spain is 48.800.000 people, more than 50 times bigger than the population of Cyprus.

Spain is considered as a high-tax country, with a complicated tax system. Income of both companies and natural persons is taxed on both national and regional levels.

The tax situation in Spain makes it crucial for many companies, investors, and individuals to consider measures to reduce the overall tax burden.

s

Cyprus: Small is beautiful – an international business hub with low taxes on gains, business profits and personal income

Cyprus is the most Eastern EU member state and one of the EU’s smallest members, with a population of only approx. 920.000 people. That is not even 2% of Spain’s population. Its nominal GDP estimated for 2024 is almost €30 billion, and its purchasing power parity (PPP) is €54,1 billion.

Cyprus attracts a continuously growing number of European and global companies, entrepreneurs, investors, and natural persons, who either relocate their business to Cyprus, set up regional headquarters, manage their global investments from Cyprus, or choose Cyprus as their new home.

s

Spain and Cyprus: Business and Tax – Business and Tax advantages

A list of just a few but striking advantages of Cyprus:

- fast-developing governmental e-services: less time and effort for businesses and individuals;

- being a small state means flat bureaucratic structures with welcoming upper management;

- English is widely spoken at all levels;

- corporate tax rate is only 12,5% flat;

- gains from the disposal of titles (such as securities, company shares, bonds, ETFs, futures, and options) are not taxable, neither at the corporate nor individual level;

- income from dividends received by companies with non-resident shareholders is not taxable;

- no withholding tax;

- Individual income is not taxable up to €19.500 annually;

- no heritage tax,

- the Cyprus non-dom tax status exempts individuals who move to Cyprus and live there permanently or for at least 60 days a year from tax on income from dividends and interest for 17 years (conditions apply);

- 50% income tax exemption for “first salaries” in Cyprus, for a period of 10 years (conditions apply);

- and many more.

s

Spain and Cyprus: Business and Tax – Audit of Annual Financial Reports

There is no mandatory auditing of annual financial reports for smaller companies in Spain. Namely, audit of annual financial reports is not mandatory in Spain, if at least two of the following criteria are met during two consecutive years:

- the balance sheet total not exceeding EUR 2.85 million;

- and/or the net turnover not exceeding EUR 5.7 million;

- and/or the average number of employees does not exceed 50 persons.

In Cyprus, all companies are obliged to submit audited annual reports to the tax authorities. Our clients from countries where auditing is not mandatory are sometimes not comfortable with the additional (but moderate) fee to be paid to independent auditors.

However, mandatory audit of annual reports of all companies has a big advantage. In countries where audit is not mandatory, tax authorities are checking the unaudited annual reports of companies on the basis of a whole year’s accountancy. This often leads to discussions between tax authorities and tax payers, if not to supplemental claims. Additionally, tax inspectors visit companies regularly for tax and VAT inspections.

The above-mentioned situations do not apply to Cyprus. Tax authorities do not scrutinize companies’ audited annual financial reports, and they do not visit companies for routine tax or VAT inspections. For the simple reason that all annual reports are always audited.

s

Spain and Cyprus: Business and Tax – Double Taxation Agreement Between Cyprus and Spain

The “Convention between the Republic of Cyprus and the Kingdom of Spain for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and gains” (or, shortly Double Taxation Agreement (DTA) between Cyprus and Spain) is in force since the beginning of 2015.

For those readers who are not familiar with Double Taxation Agreements it is worth to mention that the provisions of Double Taxation Agreements do overwrite respective provisions of the national legislation of the two countries concerned.

The DTA allows international businesses and private individuals investing in Spain to take advantage of the substantial tax benefits that Cyprus offers, and it enables Spanish investors to benefit from Cyprus as a gateway to the range of non-EU countries with which Cyprus has concluded double taxation agreements. The most important advantages of the new treaty are:

Dividends

- 0% on withholding tax rate if the beneficial owner is a company (other than a partnership) holding at least 10% of the capital of the company paying the dividend.

- 5% in all other cases.

Royalties

- 0% withholding tax rate on royalties.

Interest

- 0% withholding tax rate on royalties.

Capital Gains

- Gains from the disposal of immovable property are taxed in the country where the immovable property is situated.

- Gains from the disposal of shares or comparable interests not listed on the Stock Exchange of either country (deriving more than 50% of their value from immovable property) are taxed in the country in which the immovable property is situated. For the purposes of determining the value referred to above, the domestic law of the country where the immovable property is situated applies.

- Gains from the disposal of any other type of shares are taxed in the country of which the seller is a tax resident.

s

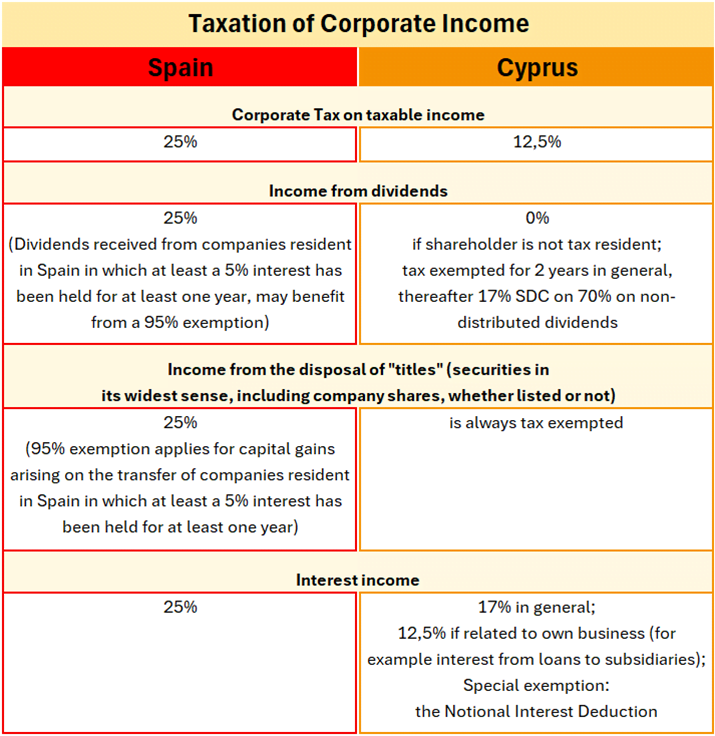

Spain and Cyprus: Business and Tax – Taxation of Income of Corporates

While the corporate tax in Cyprus is half of the Spanish corporate tax, Cyprus provides two more substantial advantages over Spain.

One of the advantages is the absence of tax on income from the disposal of “titles,” including securities such as company shares (listed or not), bonds, futures, options, and ETFs.

This makes Cyprus an ideal jurisdiction for investors who provide venture capital to startup companies at various stages. Upon exit, those investors’ gains from the disposal of equity in the invested companies will not be taxed.

For readers providing or planning to provide venture capital, we recommend reading our blog post, which explains in detail why many international investors manage their funds from Cyprus.

The other substantial advantage of Cyprus is that dividend income from a Cyprus company with non-resident shareholders is not taxable.

Please note that this is a summary and may not include every relevant detail.

s

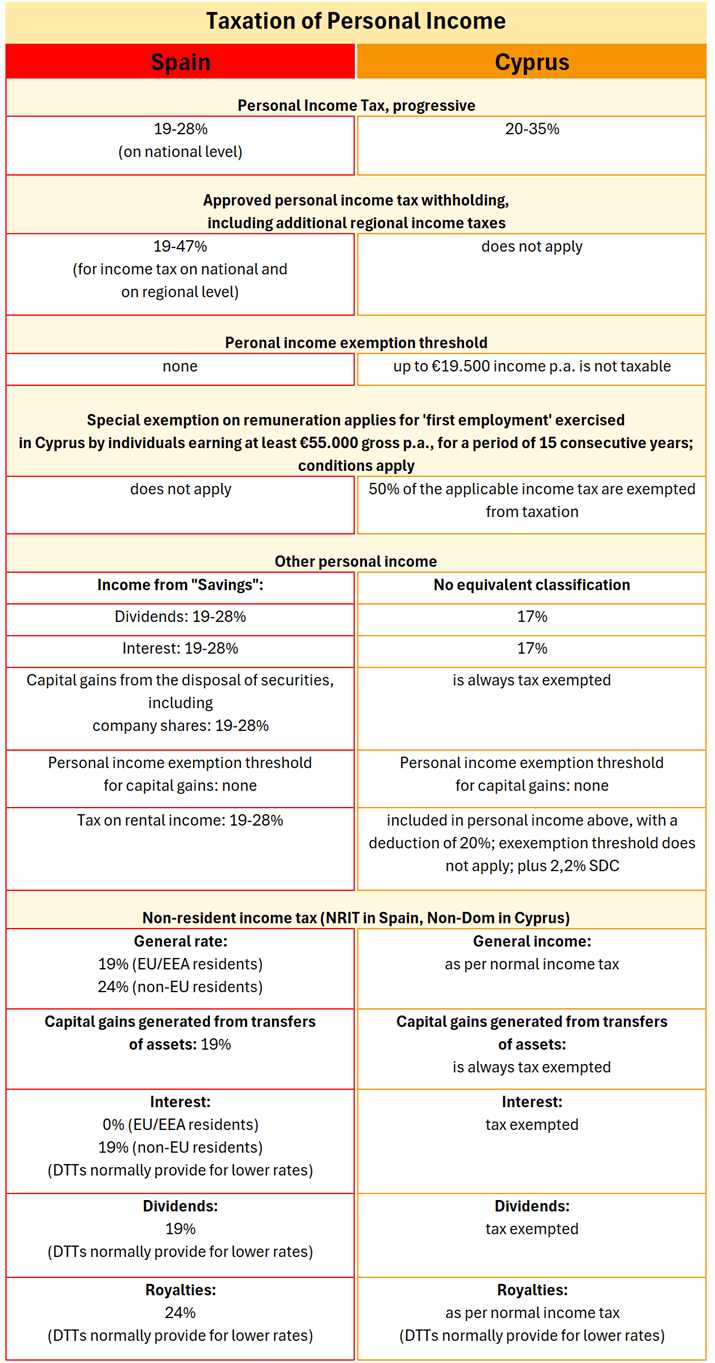

Spain and Cyprus: Business and Tax – Taxation of Personal Income

The general comparison of the figures in the table below shows that individuals in Cyprus retain a larger portion of their gross income compared to individuals in Spain.

Taxpayers in Cyprus do not pay income tax on the first €19.500 of their annual income.

There is no “national” taxation and “regional” taxation of income in Cyprus.

Again, as for companies, there is no tax on natural persons’ income from the disposal of “titles” (securities, including, among others, company shares (whether listed or not listed), bonds, futures and options, ETFs, etc).

Furthermore, natural persons who moved to Cyprus can benefit from Cyprus non-dom tax status, providing for exemption from tax in income from dividends and interest for a period of 17 years.

Please note that this is a summary and may not include every relevant detail.

s

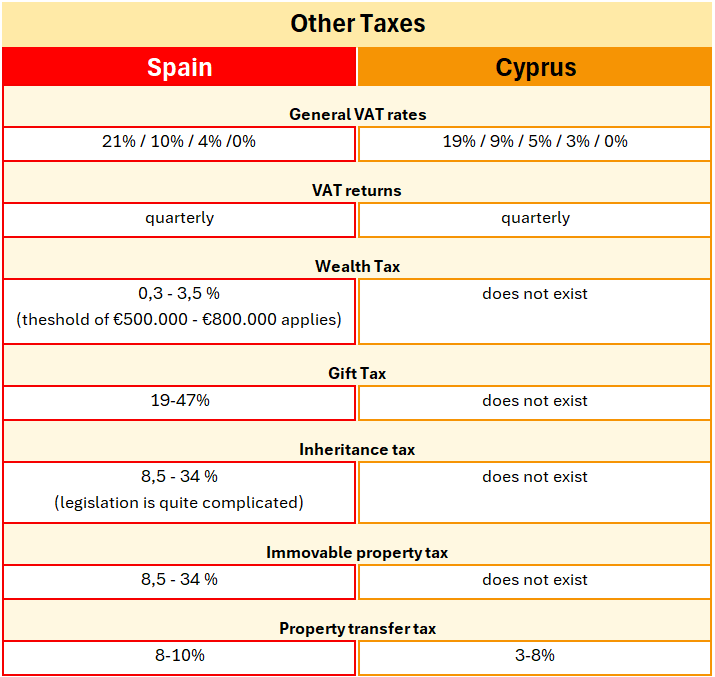

Spain and Cyprus: Business and Tax – Other Taxes

The following table highlights key differences: Cyprus, unlike Spain, does not impose the following taxes:

- inheritance tax,

- wealth tax,

- gift tax, and

- immovable property tax.

Please note that this is a summary and may not include every relevant detail.

s

Summary of the business-friendly tax landscape in Cyprus

The following list names some of the tax advantages and incentives in Cyprus. The list is not exhaustive.

- The corporate tax rate in Cyprus is 12,5% flat.

s - Dividends received from abroad are not subject to tax.

s - No tax on gains from securities (titles): Revenue from the disposal of securities in its widest sense, including privately held company shares (= company shares that are not listed on a stock exchange) is tax exempted.

s - The Notional Interest Deduction in Cyprus can reduce the tax burden by up to 80%, if companies invest own equity (capital) rather than using loans for financing their business or the business of their subsidiaries.

s - The Cyprus Non-Dom Tax Status exempts qualifying natural persons from tax on income from dividends and interest received.

s - Annual income of individuals is tax free up to the threshold of €19.500.

s - High-earners who move to Cyprus benefit from 50% income tax exemption on their salaries received from a Cyprus company, for a period of 10 years, if their annual gross salary and remuneration is at least €55.000.

s - No capital gain tax exists in Cyprus, with the exception of gains from real estate.

s - No inheritance tax in Cyprus.

s - No gift tax in Cyprus.

s

Contact us!

For further information and consulting regarding the business and tax advantages of Cyprus, Shanda Consult offers you a 30-minute complimentary video meeting (Zoom), without any obligations.

Please feel happy to contact us through the contact form below and request your complimentary Zoom meeting.

s

Disclaimer

Shanda Consult and the authors of this article explicitly disclaim any liability or responsibility to any individual, entity, or corporation that acts or fails to act based on any portion of this publication. Consequently, no individual, entity, or corporation should take action or rely on the information provided or implied in this publication without first seeking advice from a qualified professional or advisory firm like Shanda Consult, ensuring that the advice is tailored to their specific situation and circumstances.

s