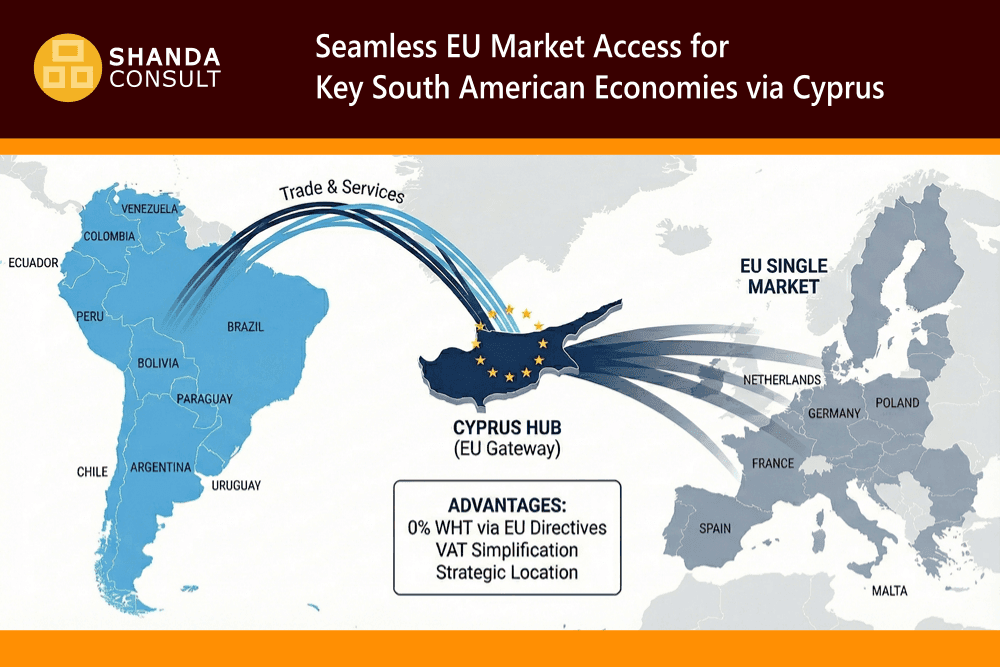

South America – Cyprus – EU

Cyprus – A Strong Gateway into the EU for South American Companies

For South American companies looking to penetrate or expand within the European Union (EU), establishing a subsidiary or sister company in Cyprus is a highly strategic move. It effectively transforms a “foreign” (third-country) business into a local EU entity, removing the administrative, fiscal, and psychological barriers that European clients face when buying from South America.

South American companies export approximately €87 billion in goods (2024) and €16-€20 in services (2023) to the EU annually, a total of €104 – €107 billion of sales from South America to the EU annually.

Our article outlines the key advantages for South American companies and entrepreneurs to strategically realign their strategy in order to sell goods and services in the EU market and strengthen their position in the EU market, benefiting from the South America – Cyprus – EU Route.

In this article you will read about:

A: South America – Cyprus – EU: Why Cyprus is Advantageous for South American Companies

B: Cyprus vs. Dubai (UAE) for Selling to the EU (Cyprus defeats Dubai)

C: The Tricky EU Withholding Tax Regulations for Services, Royalties, and Licensing Fees (The solution: Cyprus)

s

A: South America – Cyprus – EU: Why Cyprus is Advantageous for South American Companies

Taking the South America – Cyprus – EU route means choosing Cyprus as the EU jurisdiction to set up your EU presence and to serve the EU markets through your company in Cyprus.

Establishing a Cyprus company acts as your “EU Passport” for trade. It allows you to centralize imports, sales, and services for the entire European bloc in one jurisdiction.

1. Frictionless Access to the EU Single Market

The most immediate benefit is Freedom of Movement. Once your goods or services enter the EU through your Cyprus company, they are considered “EU goods/services.”

- For Goods: You can import bulk goods from South America in the name of your Cyprus company into a bonded warehouse in any EU member state (or clear customs there) and then distribute them to Spain, France, Germany, or Italy etc., without further customs checks or duties at internal borders.

- For Services: You eliminate the “foreign vendor” friction. European B2B clients often hesitate to contract directly with South American entities due to complex invoicing, uncertainty about data protection (GDPR), cross-border payment fees, and due to lack of knowledge of the laws in non-EU countries. A Cyprus contract is a contract based on EU legislation.

2. VAT Simplification (The “Reverse Charge” Mechanism)

If you sell services from South America directly to the EU, VAT compliance can be cumbersome for your customers.

- The Cyprus Solution: A Cyprus company selling B2B (business-to-business) to clients in other EU countries (e.g., Spain, Germany etc.) typically charges 0% VAT under the “Reverse Charge” mechanism. This makes your invoices cleaner and around 20%+ cheaper for the cash flow of your clients compared to scenarios where VAT might be stuck or complex to reclaim.

3. Highly Efficient Corporate Tax Structure When Taking the South America – Cyprus – EU Route

Cyprus has one of the lowest standard corporate tax rates in the EU at 15%. However, for South American groups, three specific mechanisms can drive this lower:

- Notional Interest Deduction (NID): If your South American parent company funds the Cyprus subsidiary with equity (cash injection) rather than a loan, Cyprus allows you to deduct a “fictional” interest expense from your taxable income. This can reduce the effective tax rate to as low as 2.5%.

- IP Box Regime: If your company deals in software, technology, or patents, you can develop your software etc. in Cyprus (including the right to outsource coding etc.), so that the Intellectual Property (IP) will be of Cyprus origin. Profits derived from that IP can be taxed at an effective rate of 2.5%.

- Dividend Participation Exemption: In most cases, dividends received by the Cyprus company from other investments are tax-exempt.

4. Easy Repatriation of Profits (No Withholding Tax)

This is crucial for South American owners, and opting for the South America – Cyprus – EU Route can provide substant . Cyprus generally imposes 0% Withholding Tax (WHT) on dividends paid out to foreign shareholders (provided the shareholder is not in a jurisdiction on the EU “Blacklist” of non-cooperative tax jurisdictions).

- Note: Most major South American economies (Brazil, Chile, Colombia, Argentina) are not on the EU blacklist, meaning you can often move profits from Cyprus back to South America with zero withholding tax in Cyprus.

- Note: Please read the part “C: The Tricky EU Withholding Tax Regulations for Services, Royalties, and Licensing Fees” further below and understand why doing business through a Cyprus company is so advantageous.

5. Legal Certainty (Common Law)

Cyprus is one of the few EU countries (along with Ireland and Malta) that uses a Common Law system modelled on the English legal system. This is widely understood by international lawyers and investors, offering much more flexibility and predictability than the Civil Law systems found in France or Germany.

s

B: Cyprus vs. Dubai (UAE) for Selling to the EU

Many international entrepreneurs compare Cyprus and Dubai (UAE). While Dubai is a global powerhouse, Cyprus is mathematically and operationally superior specifically for selling to the EU.

Here is the comparative analysis:

1. “Inside” vs. “Outside” the Wall

- Cyprus (EU Member): Your company is an “insider.” You have an EU VAT number and EU EORI number (for customs). You are protected by EU directives.

- Dubai (Non-EU): Your company is a “third-country” entity.

- Goods: When a Dubai company ships to the EU, the EU client acts as the “importer of record,” facing customs duties, import VAT, and delays. This friction often kills deals.

- Services: Some EU countries apply “protective” Withholding Taxes on payments made to the UAE because it is outside the EU tax harmonization framework.

2. Banking and Payments (SEPA vs. SWIFT)

- Cyprus: A Cyprus company gives you access to SEPA (Single Euro Payments Area).

- European clients can pay you via a simple local bank transfer (free or very cheap) that clears in hours.

- It signals trust. An EU IBAN (International Bank Account Number) looks “local” to a German or French client.

- Dubai: Payments to Dubai must go via SWIFT.

- These take 2–5 days and cost $20–$50 per transaction in fees and even up to 2-3% if the amount of remittance is high.

- Compliance friction: European banks have become very strict. Transfers to Dubai often trigger “AML (Anti-Money Laundering) Checks,” where the bank freezes the funds and asks your client for invoices and contracts before releasing the money. This can damage client relationships.

3. Tax Reality: 15% vs. The New UAE 9%

Historically, Dubai was 0% tax. This changed in June 2023.

- Dubai: Now has a 9% Corporate Tax on profits over AED 375,000 (~$100k).

- Free Zones: You can still get 0% in a Free Zone, but only on “Qualifying Income.” Selling goods/services to mainland UAE or failing “substance” tests can trigger the 9% tax. The rules are complex and evolving.

- Cyprus: Flat 15%. While higher on paper, it grants access to the EU Parent-Subsidiary Directive.

- The Kicker: If a Dubai company sells to an EU company, the EU company might have to withhold tax on the payment (e.g., 15-25%) depending on bilateral treaties. If a Cyprus company sells to that same EU company, the withholding tax is 0% by EU law. The 15% corporate tax in Cyprus is often cheaper than the withholding tax lost when using Dubai.

4. Data and Credibility (GDPR)

- Cyprus: Automatically GDPR compliant (if you follow the rules). This is a mandatory requirement for signing contracts with large European enterprises.

- Dubai: Considered a jurisdiction with “inadequate” data protection measures by the EU. Transferring personal data (customer lists, user data) from the EU to Dubai requires complex legal clauses (Standard Contractual Clauses), which corporate legal departments in Europe often reject to avoid risk.

Summary Table

Feature | Cyprus Subsidiary | Dubai (UAE) Subsidiary |

Market Status | EU Insider (Frictionless trade) | Third Country (Customs/Import procedures) |

Client Payment | SEPA (Fast, cheap, low scrutiny) | SWIFT (Slower, fees, high AML scrutiny) |

VAT on B2B Services | 0% (Reverse Charge) | No EU VAT (but client may have self-accounting obligation) |

Corporate Tax | 15% (can drop to 2.5% via NID/IP) | 9% (unless strictly “Qualifying” Free Zone income) |

Withholding Tax | 0% on payments from EU clients | Potential WHT deducted by EU clients before paying you |

Reputation | “Onshore” European business | “Offshore” / Tax Heaven risks |

Why “The Kicker” Matters for Dubai vs. Cyprus

This is where the Dubai vs. Cyprus distinction becomes critical for a South American owner:

- Cyprus is in the Club: Because Cyprus is an EU member, it benefits from the Interest and Royalties Directive and the general principle of non-discrimination. EU member states tax authorities cannot easily levy WHT on payments to Cyprus (unless they prove artificiality). Thus, setting up your subsidiary or sister company in Cyprus and taking the South America – Cyprus – EU Route will provide you with substantially net higher revenues.

- Dubai is “Third Country”: Even though Dubai is a business hub, to a Spanish or French tax inspector, it is a non-EU jurisdiction.

- If you bill from Dubai, the EU client often still has to apply the withholding tax (e.g., 25%) because the EU Directive protections do not apply to Dubai.

- You are then forced to rely on the UAE-EU tax treaties, which are often less favourable or subject to strict “Limitation of Benefits” clauses (meaning if your Dubai company doesn’t have significant local staff/offices, the treaty benefits are denied).

Summary of the South America – Cyprus – EU Route for South American Exporters

- Selling Coffee/Grain/goods? The WHT issue is rare. You can likely sell directly or via Dubai without this specific tax penalty (though customs/VAT friction remains).

- Selling Services, App subscriptions, IP, or Consulting? The WHT issue is a “deal-breaker.” Selling directly from South America or Dubai will likely cost you 15–30% of your revenue in withheld taxes. Selling via Cyprus guarantees you keep 100% of your invoice value.

Recommendation

- Choose Dubai if: Your primary market is the Middle East, Africa, or Asia, and you only have occasional, small clients in Europe.

- Choose Cyprus if: Your primary goal is to scale sales in the European Union. The ability to bill clients in Euros with an EU VAT number and an EU IBAN removes the “friction of doing business” that often prevents South American companies from winning European contracts.

C: The Tricky EU Withholding Tax Regulations for Services, Royalties, and Licensing Fees

Outbound payments from the EU related to services, software, intellectual property rights, or digital goods are often subject to relative high Withholding Tax.

If your South American company sells physical goods (e.g., avocados, minerals, textiles), the EU client generally does not withhold tax on the payment.

However, if you are selling services, software, intellectual property rights, or digital goods, the risk of Withholding Tax (WHT) is very real and dangerous to your margin, and that is where the South America – Cyprus – EU Route comes in for your business’ benefits.

Here is the detailed explanation of why this happens and examples involving South American entities.

The “Service Trap”: Why EU Companies Withhold Tax

Many EU countries (such as Portugal, Spain, Italy, and Greece) have domestic laws stating that payments made to non-resident entities for “managerial,” “technical,” or “consulting” services are deemed to be generated in their country and are therefore taxable there.

Since the South American company is not present to pay tax, the EU client is legally obliged to withhold a percentage of the invoice value (often 15%–30%) and pay it to their local tax authority. You only receive the remaining 75–85%. But not so if you opt for the South America – Cyprus – EU Route and set up your company in Cyprus.

Comparison: South America (Direct) vs. Cyprus (EU Subsidiary)

Here are three concrete examples of how this works.

Example 1: The Software/Tech Service (Brazil vs. Portugal)

- Scenario: A Brazilian tech company provides remote IT maintenance and software customization to a client in Portugal.

- Direct Route (Brazil to Portugal):

- Portugal treats payments for “technical services” to non-EU jurisdictions as subject to WHT (typically 25%).

- Result: You invoice €10,000. The Portuguese client pays €2,500 to the Portuguese tax office and sends you only €7,500. You lose 25% of your revenue instantly.

- Cyprus Route:

- You set up a Cyprus subsidiary. The Cyprus company bills the Portuguese client.

- Because both are EU companies, the EU “Freedom to Provide Services” rules apply. There is 0% WHT.

- Result: You invoice €10,000. You receive €10,000 in Cyprus as a result of taking the South America – Cyprus – EU Route.

Example 2: The Consulting/Management Fee (Colombia vs. Spain)

- Scenario: A Colombian consultancy firm advises a Spanish manufacturer on logistics optimization.

- Direct Route (Colombia to Spain):

- Spanish law applies 24% WHT on service fees paid to non-EU residents unless a Double Tax Treaty says otherwise. (Even with a treaty, the rate is often just reduced, not eliminated, or requires complex paperwork to prove residency).

- Result: The Spanish client, fearing liability, withholds 24%. You receive significantly less cash.

- Cyprus Route:

- The Cyprus subsidiary bills the Spanish client.

- Under the EU framework, this is a standard intra-Community service. 0% WHT.

- The full cash amount lands in your Cyprus bank account.

Example 3: Intellectual Property / Royalties (Argentina vs. Italy)

- Scenario: An Argentine design studio licenses a brand or design to an Italian fashion house.

- Direct Route (Argentina to Italy):

- Royalties paid to non-EU entities often attract 30% WHT in Italy.

- Result: You lose nearly a third of your income at the source.

- Cyprus Route:

- You transfer the IP rights to the Cyprus company.

- The Cyprus company licenses the design to Italy.

- Under the EU Interest and Royalties Directive, royalty payments between associated EU companies are 0% tax.

- You receive 100% of the payment in Cyprus.

Please contact us for a complete list of EU member states’ withholding tax rates for outbound payments related to Services, Royalties, and Licensing Fees.

Does a Cyprus company need to withhold tax when paying the South American company?

In most cases, No, the Cyprus company does not need to withhold tax when paying the South American company.

This is the key reason why Cyprus is such a powerful “gateway.” While EU countries (like Spain or Portugal) often apply withholding tax (WHT) on payments to South America, Cyprus does not – provided you follow specific rules.

Here is the detailed breakdown applied to the three examples we discussed:

1. Payment for Remote Tech Services (e.g., Software Dev/Support)

- The Rule: Cyprus only charges Withholding Tax (10%) on technical services if they are physically performed within Cyprus.

- Your Scenario: Your South American team is sitting in South America (e.g., Bogotá or São Paulo) coding or providing support remotely.

- Result: 0% Withholding Tax.

- Why? Since the team is not physically on Cypriot soil, the income is not considered “Cyprus-sourced” for WHT purposes.

2. Payment for Consulting / Management Fees

- The Rule: Cyprus generally does not levy WHT on management or consulting fees paid to non-residents.

- Your Scenario: The South American parent company charges the Cyprus subsidiary a “Management Fee” for strategic advice or shared services.

- Result: 0% Withholding Tax.

- Note: The fee must be “arm’s length” (market rate). If you pay an inflated fee just to shift profits, the Cyprus tax authority might disallow the expense (meaning you pay corporate tax on it), but they generally won’t withhold tax on the payment itself.

3. Payment for Royalties / IP Licensing

- The Rule: Historically, Cyprus had 0% WHT on royalties for rights used outside Cyprus.

- Your Scenario: The Cyprus company pays royalties to the South American owner for the right to use the brand/software, which it then sub-licenses to customers in France or Germany.

- Result: 0% Withholding Tax.

- Why? Because the rights are being exploited in the EU market (outside Cyprus), Cyprus does not tax the outflow to South America.

The Two Critical Exceptions (Safety Checks)

There are two specific situations where Cyprus will withhold tax. You must ensure your South American company does not fall into these categories:

Exception A: The “Blacklist” Rule (The EU Blacklist)

Cyprus strictly applies “Defensive Measures” against jurisdictions on the EU List of Non-Cooperative Jurisdictions.

- If your company is in: Panama, Trinidad & Tobago, or US Virgin Islands (among others), Cyprus will apply severe taxes:

- 10% WHT on Royalties.

- 17% WHT on Dividends.

- 30% WHT on Interest.

- Safe Countries: Major South American economies like Brazil, Argentina, Chile, Colombia, Peru, and Uruguay are currently NOT on this list. If you are in these countries, you are safe (0% WHT).

Exception B: The “Low Tax” Rule (New for 2026)

Starting January 1, 2026, Cyprus will introduce penalties for payments to “Low Tax Jurisdictions” (defined as having a corporate tax rate lower than 6.25%).

- Impact: If your South American entity pays less than 6.25% tax (perhaps due to a special Free Trade Zone or tax holiday in your country), Cyprus may deny the tax deduction for the payment.

- Consequence: The Cyprus company cannot deduct that expense from its profits, effectively paying the 12.5% Cyprus corporate tax on that money before sending it out.

- Safe Scenarios: Standard corporate tax rates in South America (e.g., Brazil 34%, Colombia 35%, Chile 27%) are well above 6.25%, so this rule will likely not affect you.

Summary Comparison

Payment Flow | EU Client → South America (Direct) | EU Client → Cyprus → South America |

Tech Services | 15% – 30% Tax Lost (WHT applied by EU client) | 0% Tax Lost (No WHT in Cyprus) |

Royalties | 20% – 30% Tax Lost (WHT applied by EU client) | 0% Tax Lost (No WHT in Cyprus*) |

Net Result | You receive ~75% of your money. | You receive 100% of your money.** |

*Assuming the South American country is not on the EU Blacklist.

**Subject to the small banking fees and annual maintenance of the Cyprus structure.

Conclusion

Entering the EU markets or restructuring the current flow of goods and services from Sout American countries to EU markets provides substantial advantages when taking the South America – Cyprus – EU Route, meaning to reach out to EU markets via your own company in Cyprus, rather than selling directly.

We consult South American clients since years and assist in setting up their companies and presence in Cyprus.

We will be happy to share your experience with you. Please contact us for an initial free-of-charge video meeting.

a

Disclaimer:

The information provided in this article is for general informational purposes only and does not constitute legal, financial, or tax advice. While we strive to ensure that the information presented is accurate and up to date, tax laws and regulations are subject to change and may vary based on individual circumstances. We strongly recommend consulting with a qualified tax advisor or legal professional before making any financial or business decisions based on the information provided here.

Shanda Consult does not accept any responsibility or liability for any loss or damage incurred as a result of the use of this information.

s

s