My Modest Tax Bills in Cyprus

The Republic of Cyprus is not only one of the safest countries in the world but also an attractive destination for businesses and investors due to its well-designed tax policies. These policies allow individuals, entrepreneurs, and companies to retain a larger portion of their income compared to other countries.

In this article, we explore how businesswoman and investor Clara M. benefits from Cyprus’s tax advantages. By relocating and running her business from Cyprus, Clara saves more than 80% in taxes compared to the average tax rates in many other countries.

s

Clara’s Experience:

“I moved to Cyprus in June 2022 after visiting the country twice in 2021 and again in February 2022. I travel frequently for business, and I was drawn to the relaxed lifestyle and the safety of Cyprus, which boasts a very low crime rate.

However, what attracted me the most was Cyprus’s modest taxation, both for individuals and businesses. In fact, many types of investments are not taxed at all, which significantly lowers my tax bill here.

My company specializes in buying and selling essential oils worldwide. Most of our suppliers are located in the West Indies, East Africa, Mediterranean countries like Spain, Italy, and Greece, as well as India and Southeast Asia, so I travel extensively. My customers are primarily based in Europe, with a few in North America.

In addition to running my company, I invest in startups, mainly biotech startups related to my business. I also make private investments to secure my family’s financial future, including certain funds and stock market investments.”

s

Shanda Consult: “That’s fantastic. Could you share the specific tax advantages you enjoy in Cyprus?”

Clara: “Sure, I only say ‘my modest tax bills in Cyprus!”

“There are numerous tax benefits in Cyprus, which result in a very moderate tax burden for me. I operate my own company here, and the corporate tax rate is only 12.5%, which is quite competitive compared to most other countries. This tax applies solely to our commercial profits, not to the gains from our financial investments.

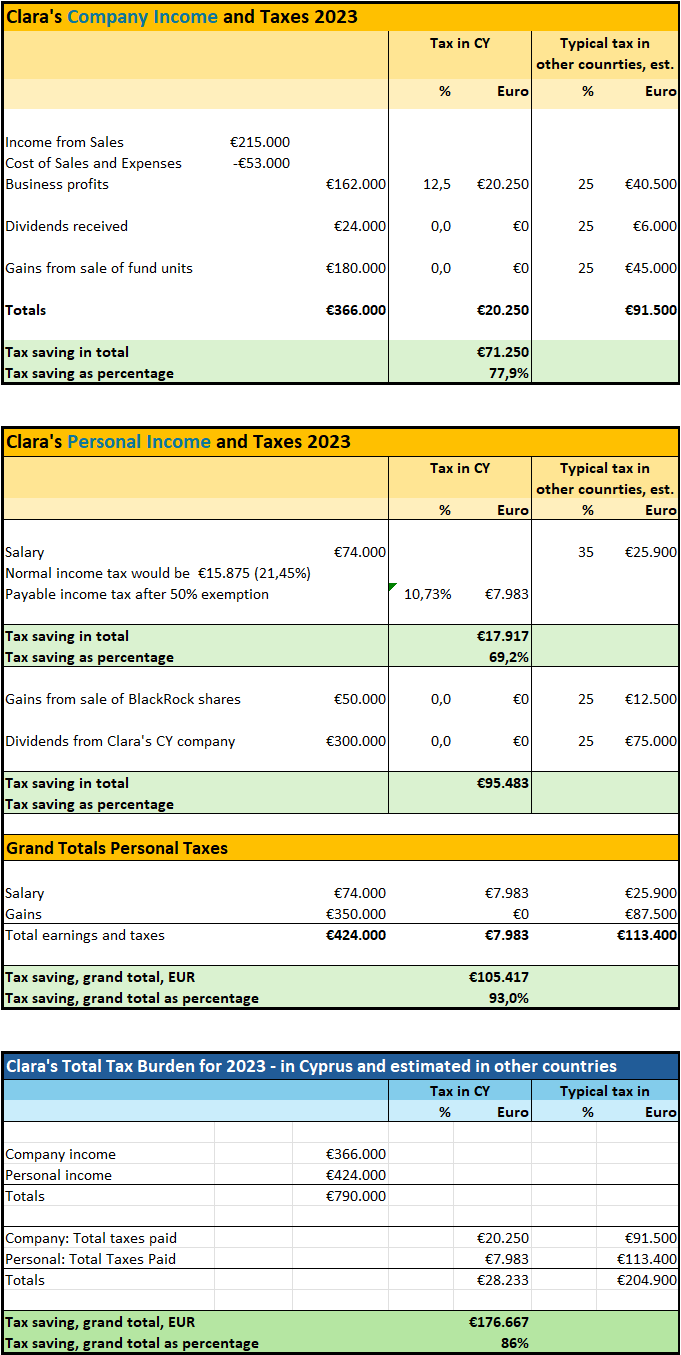

2023 was not an exceptional year for us due to various factors. Our company had a gross profit of €215,000 and a net profit of €162,000, on which we paid the 12.5% corporate tax—amounting to €20,250.

Additionally, my company received €24,000 in dividends from a European company where we hold a minor stake. Dividends received by a Cyprus company from abroad are not taxable.

In December 2023, we sold fund units that my company had invested in, earning a profit of nearly €180,000. Since gains from the sale of securities are not taxable in Cyprus, we saved approximately €40,000 to €50,000 in capital gains tax compared to other countries.

Furthermore, my company pays me an annual salary of €74,000. I benefit from a 50% income tax exemption for high earners in Cyprus, which lasts for a total of 17 years. Without this exemption, the annual income tax on my salary would be just under €16,000, roughly 21%. However, thanks to the exemption, I save nearly €8,000.

I also had some BlackRock shares as a private investment, which I sold late last year with a profit of €50,000. Gains from the disposal of securities are generally not taxable in Cyprus, which I greatly appreciate.

Lastly, after our company’s annual financial statements were audited, I received €300,000 in dividends. Benefiting from my Cyprus Non-Dom Tax Status, I am exempt from the 17% Special Defence Contribution, which would have otherwise amounted to €51,000.”

s

Shanda Consult: “It seems like you truly enjoy the concept of your ‘modest tax bills in Cyprus.’ Do you have an idea of the total tax advantages you gained in 2023?”

Clara: “To be honest, I haven’t calculated that yet. However, we can go through it together to see just how modest my Cyprus tax bill for 2023 is.”

s

We then sat down with a pen and paper to tally up Clara’s and her company’s income and taxes. The results were remarkable, highlighting the incredible tax advantages of living and conducting business in Cyprus. The table below provides a general calculation based on Clara’s and her company’s income and taxes, though some minor details have not been included.

Cyprus is a truly unique destination, attracting thousands of individuals, businesses, and investors to relocate.

Clara, a strong advocate for Cyprus, proudly promotes it with her slogan, “My Modest Tax Bills in Cyprus,” at every opportunity.

ss

Contact us!

For further information and consulting regarding the business and tax advantages of Cyprus, Shanda Consult offers you a 30-minute complimentary video meeting (Zoom), without any obligations.

Please feel happy to contact us through the contact form below and request your complimentary Zoom meeting.

ss

Disclaimer

Shanda Consult and the authors of this article explicitly disclaim any liability or responsibility to any individual, entity, or corporation that acts or fails to act based on any portion of this publication. Consequently, no individual, entity, or corporation should take action or rely on the information provided or implied in this publication without first seeking advice from a qualified professional or advisory firm like Shanda Consult, ensuring that the advice is tailored to their specific situation and circumstances.

s