Cyprus – for local and international business, and for headquartering

Cyprus is the fastest growing tech hub in the European Union.

Not only tech companies are enjoying the business and lifestyle benefits of Cyprus. Cyprus is a stronghold for many international companies that do business in Cyprus, the Eastern Mediterranean region or globally.

A growing number of international companies is opting for Cyprus as their location for regional or global headquartering.

Well-known foreign companies established their presence in Cyprus, some of them decades ago, and some of them during the last few years.

To name just a few:

- NCR (origin US; point-of-sale terminals, automated teller machines, check processing systems, and barcode scanners);

- Amdocs (origin US; software & services provider to communications & media companies)

- TSYS (origin US; financial technology, third-party payment processor, largest in the US, one of the largest in Europe);

- Murex (origin France; financial software for trading, treasury, risk, and post-trade operations for financial markets);

- Bouygues (origin France; industrial group. construction, media, communications);

- 3CX (origin Cyprus; software-based private branch exchange (PBX) Phone system);

- Kardex (origin Switzerland; global industry partner for intralogistics, automated storage solutions and material handling systems);

- Wargaming (origin Belarus, global video game company headquartered in Nicosia);

- Exness (origin Russia; global multi-asset broker, trading platform);

- Monaco Telecom (owns Cyprus mobile phone provider Epic);

- Melsoft Games (origin Lituania; video game developer focusing on casual mobile games);

- Kyndryl (U.S.; large-scale information systems);

- MUFG Investor Services (origin Japan; investment arm of Mitsubishi Bank);

- Nexters (Cypriot video game company headquartered in Limassol, recently listed on the Nasdaq);

- and recently the German electric tools manufacturer STIHL;

- as well as Wrike, Inc. (origin US; project management application service provider).

The fastest growing sector in Cyprus is the tech industry. While the tech industry contributed just around 2-3 % to the GDP of Cyprus a few years ago, it now does contribute more than 8% to the GDP, and thus it did surpass both the shipping sector and the tourism industry.

When companies are deciding whether to relocate to Cyprus, well-being of staff matters as well. The good quality of life, the safety families feel, the Mediterranean climate, the beautiful beaches, as well as the rich cultural heritage, and Cyprus’ friendly and welcoming people are important factors.

In 2022, foreign companies relocating to Cyprus increased by more than 50%; the total number of jobs created increased by almost 80%. The total impact on the economy was estimated at EUR 3 billion.

Professionals moving to Cyprus during the last two years represent an added spending power of almost two billion euros a year.

For European companies, Cyprus offers the advantage of being an EU member itself, and it provides easy reach to the entire Middle East. Companies from the US and other non-European countries prefer Cyprus as their gate to the European markets.

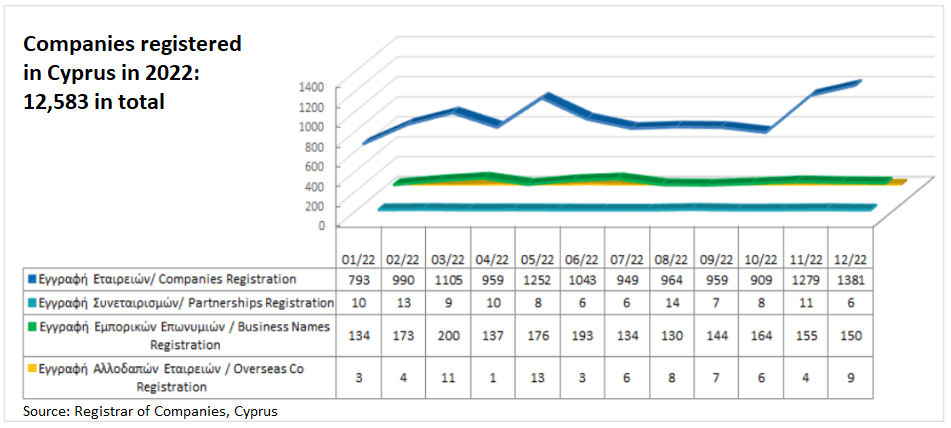

In 2022, a total of 12,583 companies have been registered in Cyprus.

Businesses and professionals from Europe, America and the Middle East clearly focus on Cyprus for their expansion, regional or global headquarters, and because of the ease of doing business and the pleasant lifestyle in Cyprus.

Following you will find various arguments and reasons in favour of Cyprus. Feel free to contact us for more detailed information.

CYPRUS – General Advantages

- Cyprus is among the 5 safest small countries worldwide (ValuePenguin and French travel cover company Insurly);

- Nicosia ranks first in small European cities list for human capital and lifestyle, for the fifth time (evaluation by Financial Times);

- Among the lowest office rents in Europe;

- Labour costs for professional and technical staff much lower than in most European countries;

- Cost of doing business is generally lower than in most European countries;

- Cost of living is lower than in many countries (Cyprus ranks 35th out of 135 countries based on Numbeo);

- English is business language and widely spoken, even in daily life.

CYPRUS – Governmental incentives, facts, and ease of doing business

- Time spent at Registrar of Companies has been reduced to a week

- Employment of non-EU nationals (amended in January 2022)

- For employees: residence and work permit for up to 3 years, renewable;

- For Directors and middle management; no time limit;

- Company may employ 100% non-EU staff, max. 70% as per 1/1/2027, however, the Ministry will review conditions at that date, with the right to extend the deadline;

- Family reunification reg. the above;

- Spouses are allowed to work;

- Minimum capital/investment requirement: €200,000 (introduced in December 2022);

- Applications to Immigration Department for relocations of employees in 2022, until end of Sep. 2022: 9,090 (5.475 in 2021);

- Applications to Immigration Department for family members in 2022, until end of Sep. 2022: 4,653 (4.242 in 2021);

- Separate desk at Immigration Department, to expedite procedures; the department is currently establishing a unit to further speed up visa applications for foreign professionals, which should be fully operational within four-to-six months.

- Mandatory audit scrapped for companies with less than €200,000 annual revenue;

- The minimum period to obtain the right to apply for Cyprus citizenship after having lived and worked in Cyprus has been reduced from 7 to 5 years.

CYPRUS – General Tax benefits and advantages in Cyprus:

- For companies:

- Corporate tax only 12,5% on taxable income;

- No corporate tax liability on dividend income for two years;

- No corporate tax on gains and income from securities;

- Exemptions as per the IP-Box Regime; effective tax liability is based on each individual case, generally around 3.5% and 6%;

- No withholding tax on outbound payments of dividends, royalties and interest;

- Tax credits applicable if similar tax paid in another country;

- Full group tax relief (losses of one company in a group of companies is allowed to be set off by the profits of another group company);

- IP-Box Regime, proven by the EU;

- For shipping companies: beneficial tonnage taxation.

- For individuals:

- Annual income tax allowance 19.500 (no tax liability for annual gross salaries up to 19.500);

- Income tax thereafter as per the following brackets, each bracket’s percentage applying to the specific bracket income only):

€19,501 – €28,000 – 20%

€28,001 – €36,300 – 25%

€36,301 – €60,000 – 30%

€60,001 and above – 35%; - 50% income tax exemption for high earners (min. 55.000/year, previously 100.000); was initially for 10 years, expanded to 17 years on 14/07/2022 for all current eligible employees and newly eligible employees;

- New tax residents of Cyprus are exempted from tax liability on income from worldwide dividends and interest for 17 years (non-dome status);

- No income tax on gains and income from securities;

- No inheritance or succession tax;

- Tax on pensions received is only 5% (conditions apply).

Shanda Consult advises and serves companies and individuals in (almost) all matters of business setup, from entrepreneurial small companies to industrial establishments. While our focus is on Cyprus, where we are well established since 14 years, we do also consult and serve clients with their business setup and all related matters in the United Arab Emirates, mainly in the Emirates of Dubai and Ras Al Khaimah.

Feel encouraged to contact us for a first complimentary meeting (face-to-face in Cyprus or on Zoom) and get a first impression of our professional approach.

.N