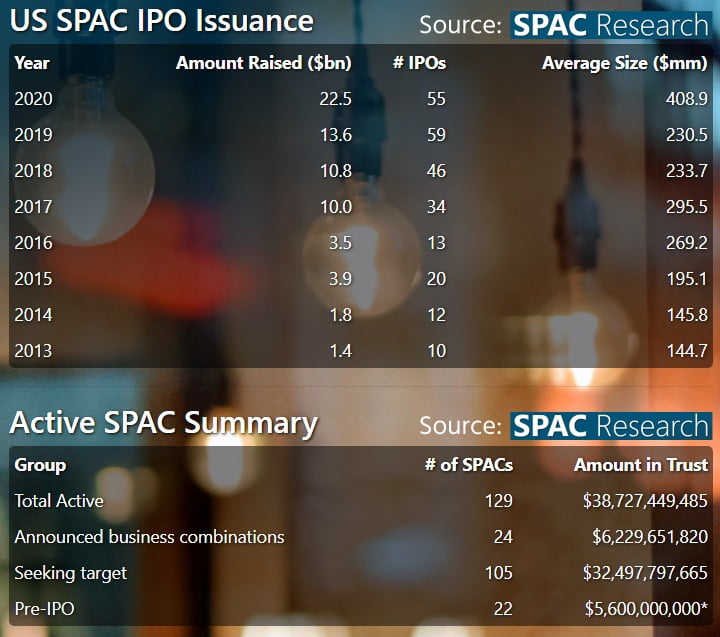

55 SPAC IPOs in the US in 2020 until the end of July – 2020 will be remembered as the year when SPACs became the new IPO. Special Purpose Acquisition Companies are broadly attracting Private Equity during the pre-IPO stage, due to SPACs’ clear and short-term exit strategy and potentially high gains.

Source: https://www.spacresearch.com/

Source: https://www.spacresearch.com/

The Drivers for SPACs’ Surge

Failing quantitative easing policies, negative or extremely low interest policies, political global uncertainty, extended market uncertainty, and finally COVID-19 were the main drivers for the incredible surge of SPACs in 2020, an incredible surge, both in numbers of SPAC IPOs and size of SPAC IPO proceeds.

While 2018 with 46, and 2019 with 59 SPAC IPOs have already been very good years for SPACs, 2020 is the year of the real break-through of SPACs. It is the year where SPACs established themselves as a widely recognised alternative for pre-IPO Private Equity Investors, large institutional IPO investors, and for private companies as an alternative and preferred way to get public.

SPACs in 2020 – Figures

In addition, the 55 SPAC IPOs this year, there are additional 22 SPACs filed with the S.E.C. Once approved, they will do their IPOs.

As SPAC consultants, we are having hard time to keep our postings and information updated, so fast are the developments on the SPAC market. The current status of US SPACs, as per today, 30th of July 2020, is breathtaking.

There are currently 129 active US-listed SPACs in total. If we deduct the number of SPAC IPOs in 2020, 74 of the active SPACs had their IPO in 2019 or 2018. 20 of those 74 SPACs will expire this year unless they consummate a business combination (acquisition) prior to their deadline,

Of the 129 currently active SPACs, 24 announced a business combination (acquisition). 109 SPACs are currently seeking acquisition targets. Those SPACs seeking targets have a total of $32,5 billion cash on trust account, which translates to acquisitions expected in the range of roughly $97,5 – $130 billion.

The above information is based on the excellent statistical work of SPAC Research.

Shanda Consult SPAC Consultants: Our holistic approach to SPACs

As experienced SPAC consultants or SPAC advisors, we provide our SPAC advisory and project management services to different group of clients related to SPACs.

Our SPAC consulting and project management services are tailor-made for private equity investors who wish to invest in their own SPAC on the pre-IPO stage as so-called SPAC Sponsors, or who prefer to sponsor an existing SPAC project at its pre-IPO stage.

As SPAC consultants, we are designing and structuring SPACs, arranging for S.E.C. approval and listing at Nasdaq or NYSE, organising pre-IPO roadshows, arrange for IPOs and assist in finding acquisition targets as per a SPAC’s acquisition strategy. Our SPAC consultants and advisers are well experienced on all stages and aspects of SPACs.

If you are interested in setting up a SPAC or in participating in an existing SPAC on its pre-IPO stage, we will be happy to arrange an initial Zoom conference to get acquainted, to further elaborate on SPACs and their manifold opportunities, and to discuss with you your SPAC investment and business ideas.