Social contribution 2023 in Cyprus: Salaries and salaried remunerations are subject to various social contributions, including contribution to the relatively new National Health System in Cyprus.

Following we provide you with an overview of the different social contribution costs in Cyprus, separated for employees and employers, and additional information for employed persons benefiting from 50% personal income tax exemption.

Social contribution 2023 in Cyprus: The Department of Social Insurance Services of the Ministry of Labour, Welfare and Social Insurance is responsible for the formulation of policies, their implementation, supervision and control of application. Officers of the department may visit business places to check unregistered employment.

Cyprus companies are obliged to withhold social contributions payable by employees for further payment to the Social Insurance Services, and to pay the social contributions payable by employers.

.

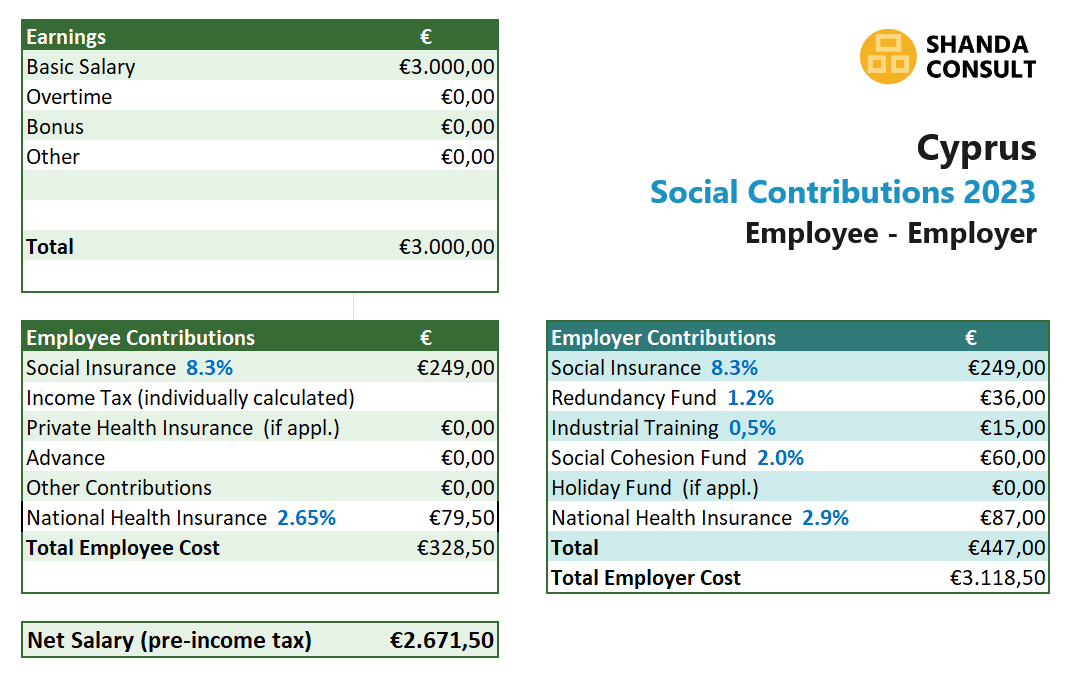

Social contributions 2023 in Cyprus – Payable by employees

Social contribution 2023 in Cyprus: Social contribution payable by employees is deducted from the basic salary, often referred to as the gross salary during employment interviews, salary negotiations or on employers’ employment offers.

Social contribution payable by employees in Cyprus comprises the employee’s part of the Social Insurance Contribution and the employee’s part of contribution to the National Health System, called GESY. The employee’s part of the Social Insurance Contribution is 8.3% and the employee’s contribution to the National Health System is currently 2.65%. Both contributions are deducted from the basic salary.

As a result, the total deductions for social contributions payable by employees is 10.95%.

The Social Insurance Contribution by employees will be increased to 8.9% from 1st of January 2024. There is no increase planned for the contribution to the National Health System GESY until 2030.

.

Social contributions 2023 in Cyprus – Payable by employers

Social contribution payable by Cyprus employers is not deducted from the basic salary (gross salary) but calculated as separate employment costs borne by the employer in addition to the basic salary.

The employer’s social contributions consist of the following items:

- Social Insurance Contribution: 8.3%

- Redundancy Fund: 1.2%

- Industrial Training Contribution: 0.5%

- Social Cohesion Fund: 2.0%

- National Health Insurance (GESY): 2.9%

Thus, the total of the contributions payable by the employer amounts to 14.9%.

There is an additional contribution of 8% called Holiday fund, which is applicable only to the salary of seasonal employees.

The Social Insurance Contribution by employers will also be increased to 8.9% from 1st of January 2024. And again, there is no increase planned for the contribution to the National Health System GESY until 2030.

.

Personal Income Tax and Social Contribution calculation

Personal income tax has not been included in this article and the calculations of social contributions as income tax payable does vary based on each tax payers’ situation.

However, we want to draw your attention to a question that we do often receive.

High-earners who have moved to Cyprus and earn an annual income (salary plus salaried remunerations) of more than EUR 55,000 are often entitled to an exemption of personal income tax on 50% of their annual income.

In such cases, the aforementioned social contributions are calculated on the basis of the annual income before the tax exemption.

Technically, in case of an annual salary of e.g. EUR 90,000, provided the tax payer is entitled to 50% income tax exemption, the calculation is applied as follows:

Both social contributions to be paid by both employee and employer are calculated based on EUR 90.000.

For the purposes of calculating the payable tax, 50% of the taxable income is disregarded and the remaining 50% is subject to the calculation of income tax based on the normal tax brackets. The general annual income tax allowance remains valid, meaning that an annual income of up to EUR 19,500 is never taxable in Cyprus.

.

You are welcome and encouraged to contact us with your further questions about social contributions in Cyprus through the contact form below.

.

.